Decentralized exchanges (DEXs) are great platforms to find new crypto token offerings. That’s because many new crypto projects go straight to DEXs to release their tokens to the public. This process is known as an initial DEX offering, or IDO.

In this guide, we’ll explain everything investors need to know about IDOs, from how they work to how to join one.

IDOs Explained

An IDO is the process by which a new crypto project releases its token to the public through a decentralized crypto exchange. It has many similarities to an initial coin offering (IEO), in which projects release tokens through centralized crypto exchanges.

In an IDO, a token works with an exchange to set a listing date and time for the new token. Starting from that time, users of the DEX can purchase the new crypto token at a set price until the number of tokens allocated for the IDO are sold out.

Examples of DEXs that offer IDOs include Uniswap, Sushiswap, and Pancakeswap. New crypto projects typically host IDOs on these large and widely used DEXs, although it’s also possible to hold an IDO on a smaller DEX.

For investors, an IDO is a chance to get in on the ground floor of a new crypto project and buy the token at a set price before it begins trading. For the crypto project, an IDO is a chance to sell tokens in exchange for other major cryptos or fiat. These funds can be used for project development. IDO providers benefit from IDOs because they generate trading volume and revenue from trading fees.

How Do IDOs Work?

An IDO for finance begins with a new crypto project working with a DEX to list its token. Some DEXs will allow any project to host an IDO on the exchange with no scrutiny. Other DExs require projects to be voted on by the DEX’s community of tokenholders or sponsored by several community members.

Once a DEX accepts a project for an IDO, the project must set up a smart contract. The smart contract creates a liquidity pool with the project’s tokens and sets a price for the new token. Investors in the IDO receive tokens from this liquidity pool.

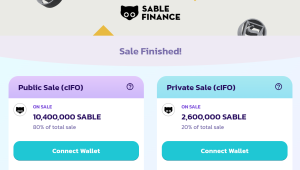

For many types of IDO, participation is limited to investors who sign up ahead of time. For example, investors might need to follow a project’s social media channels to get on an IDO whitelist. IDOs can be open to anyone at launch, but this causes a rush to buy that many investors and projects would rather avoid.

Trading in a new token usually begins immediately after a financial IDO. Traders who receive the token during an IDO may be able to sell their coins right away on the DEX that held the IDO or on another DEX. However, some IDOs come with lock-up periods that prevent investors from selling their tokens for several days or weeks.

Examples of Initial DEX Offerings

To better understand how IDOs work, let’s take a look at 2 examples of IDOs in action.

Clearpool

Clearpool is a DeFi project that allows institutional investors to borrow from liquidity pools in multiple cryptocurrencies. The project held an IDO for its $CPOOL token on the Unsiwap DEX on October 28, 2021.

This IDO didn’t have a whitelist or waiting list. Starting at 1pm UTC on the 28th, anyone could connect a wallet to Uniswap and purchase $CPOOL tokens at the IDO price of $0.04. Investors simply needed to search for the contract address for the IDO smart contract to purchase $CPOOL from the dedicated token pool.

Clearpool raised $3 million from sales of its $CPOOL token during the IDO.

milestoneBased

milestoneBased is another DeFi project that brought smart contracts to the startup financing process. The project held an IDO on Pancakeswap on March 24, 2022 at a price of $0.10 for its $MILE token.

Like for Clearpool, the milestoneBased IDO didn’t require investors to sign up for a whitelist. Anyone could join the IDO, and the price rose to $0.21 within 48 hours after the IDO sold out.

IDOs vs ICOs

IDOs and ICOs (initial coin offerings) often go hand-in-hand. In an ICO, a new project offers its crypto token to investors through mechanisms like a presale. Instead of going through an exchange, the project sells its token directly to the public.

Whereas an IDO requires a partnership between a crypto project’s team and the IDO provider, an ICO only depends on the crypto project team. This can create more flexibility and allow the project to offer lower prices for its token.

Many projects hold a presale or another form of ICO prior to holding an IDO. In this case, the IDO typically lists the token at a higher price than what investors could buy it for during the ICO. ICO investors may be able to sell their tokens during the IDO to realize a profit.

IDOs vs IEOs

IEOs (initial exchange offerings) involve a project selling its token to the public through a centralized crypto exchange instead of a DEX.

Centralized crypto exchanges typically conduct due diligence on projects before accepting them for an IEO. While some DEXs conduct due diligence, most do not. Due diligence doesn’t guarantee that a token will rise in value, but it can help cut down on scams.

Importantly, IEOs aren’t available to everyone. Investors must be a member of the centralized exchange that is holding the IEO in order to buy tokens. Often, only investors who also own the exchange’s native token can qualify to join an IEO. In contrast, anyone with a crypto wallet can connect to a DEX and join an IDO (although some IDO sources do require whitelisting).

In addition, IEOs are limited by geography since many crypto exchanges don’t accept customers from certain countries. For example, many exchanges don’t accept US customers since it remains unclear whether crypto tokens are securities under US law. IDOs are available to everyone, regardless of what countries they live in.

IEOs also have much higher fees than IDOs. Centralized exchanges usually charge a listing fee plus take a percentage of the total token sales. Decentralized exchanges may charge a small listing fee, but mainly earn revenue from the trading fees that an IDO generates.

Why Do People Invest in Initial DEX Offerings?

There are several reasons why investors look for IDOs.

Price Speculation

The biggest reason why IDOs are so popular among crypto investors is that they offer a chance to get in early on a new project’s token. Most IDO investors are betting that the token will rise in value once it starts open trading on DEXs.

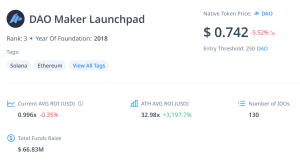

IDO platforms like the DAO Maker launchpad yielded average returns of up to 3,200% during the crypto bull market. While the current average return hovers around -1%, many investors think that IDOs could start to deliver huge gains again. That feeling is particularly prevalent amid predictions that the crypto winter is coming to an end.

In most cases, investors who purchase a token during an IDO can sell it immediately if they so choose. Once a token completes its IDO, it will be available for trading on any DEX.

Some IDO tokens also offer staking rewards. Staking rates may be higher during the early stages of a project, meaning that investors who join during the IDO can lock in better returns.

Investor Safety

One benefit of an IDO compared to an ICO is that the smart contract behind an IDO is co-managed by the crypto project’s development team and the DEX. This offers investors with more trust in the smart contract and the terms of the sale.

Importantly, IDOs don’t include the same due diligence measures as IEOs. So, there is still a risk that a project could conduct a rug pull or use other scammy tactics. However, going through a major DEX does provide some level of safety for investors.

Access to New Tokens

Another benefit of an IDO is that this process makes it relatively straightforward to invest in new crypto tokens.

For most IDOs, investors simply need to connect a wallet to the DEX holding the IDO in order to participate. Some IDOs have whitelisting requirements, but these are usually easy to fulfill (e.g. following a project’s Twitter account).

Unlike centralized exchanges, DEXs accept customers from anywhere in the world and most don’t require identity verification. So, anyone can join an IDO, not just existing members of an exchange.

Why Investing in an ICO Can be Better Than an IDO

While IDOs have many important benefits, crypto investors often prefer ICOs to IDOs. There are a few reasons for this.

First, ICOs are considered by many investors to be more fair than IDOs. Crypto presales are usually open to any investors and don’t have whitelisting requirements. All investors need to do to join an ICO is connect a crypto wallet.

Presales typically go on for days to weeks, so investors also don’t have to pile into a sale all at the same time. This is much more fair for investors around the world who may be forced to buy tokens in an IDO in the middle of the night in their timezone.

Another benefit to ICOs is that they have lower costs for projects, including no listing fees. As a result, crypto projects can offer their tokens to investors at a lower price and still raise the same amount of money. For investors, buying a token at a lower price means they stand to earn a greater return if the token reaches the same market cap once trading begins.

Notably, many projects hold an ICO before holding an IDO. That means that investors in an ICO can lock in a lower price for a token than investors in an IDO for the same token. So, ICO investors can potentially earn unrealized gains at the time of an IDO and may choose to sell immediately for a profit or hold onto their tokens in pursuit of even bigger gains.

How to Find IDOs

IDO investors spend a lot of their time finding and researching potentially profitable IDOs. There are new projects launching all the time, but investors need to know where to find them in order to get whitelisted and invest at launch.

We’ll cover a few ways that investors can find promising IDOs.

Research IDOs Using ICOBench

ICOBench is a powerful platform to help investors find IDOs. We offer a calendar that shops all upcoming token listings on DEXs, including tokens that are going straight to an IDO with no presale. Investors can check not only which DEX a token is listing on but also whether there are any whitelisting requirements.

Investors can also check our ratings and reviews for IDO cryptos. These scores can be very helpful for identifying high-potential tokens that investors are ready to pounce on once trading begins.

Our platform also offers tools for investors to research the development teams, tokenomics, and more behind each new IDO token. This enables investors to find the best projects even when DEXs don’t provide research about the tokens they’re listing.

Monitor Social Media

Social media is another great place to find out about upcoming IDOs. Most new crypto projects have a strong presence on Twitter, and many also promote themselves on Reddit and Instagram. Once investors find a project they like, they can join the project’s Telegram or Discord groups to stay up to date on the latest listing announcements.

Monitoring social media is especially valuable for IDOs since many projects require investors to follow or share their social accounts in order to get on the whitelist for an IDO.

Investors can also follow IDO hedge funds, which are funds that invest primarily in IDOs. These funds often discuss the projects they’re investing in because it’s in their interest for other investors to get behind a new token.

Follow DEX Launchpads

DEX launchpad platforms such as Uniswap, DAO Maker, and Pancakeswap often take part in marketing the IDOs they’re hosting. So, simply following these DEXs on social media can help investors stay abreast of what IDOs are coming up. Many DEXs also have their own calendars and announcement pages on their websites to highlight new IDOs.

Beware of marketing hype when following DEXs directly. These platforms want to encourage trading in an IDO, regardless of whether a specific project has a lot of potential or not.

How to Pick High Potential IDOs & Avoid Scams

Once an investor has found potential IDOs to join, it’s important to thoroughly vet them to find the best projects and avoid scams. We’ll offer some tips for how to find the top IDO projects to invest in.

Read the Whitepaper Carefully

The most important thing an investor can do before joining any IDO is to read the project’s whitepaper. Every crypto project should have a well-developed whitepaper before listing on an exchange.

The whitepaper lays out everything investors need to know about a project. Points it should cover include:

- What problem the project is solving and how

- What the project’s token does

- The coin’s tokenomics

- The project’s roadmap for future development

- How the project compares to existing solutions

The whitepaper should be as specific as possible about how a token will work and what investors will get out of holding it. There should also be a clear link between the project’s success and price appreciation in the token or rewards paid to tokenholders.

If a project doesn’t have a whitepaper or the whitepaper is vague, consider that to be a red flag. Many scammy projects put out short whitepapers that are thin on details in the hopes that investors won’t look at them too closely.

Look for Smart Contract Audits

Reputable crypto projects almost always share their code with a third-party audit service like Certik or Coinsult prior to launch.

These services comb through a project’s smart contracts to ensure the token is secure and does what the project’s whitepaper says it will do. For example, an audit can confirm that the maximum supply of a crypto token is properly limited by the token’s smart contract.

Project teams normally make the results of their audits available to investors to review prior to an IDO.

Know the Development Team

With any crypto project, investors are putting a lot of trust in the development team’s ability to deliver and follow-through on a roadmap. So, it’s important to know who the developers are and what experience they bring to a project.

Many projects now dox their development teams, meaning that they reveal the developers’ identities. This allows investors to research these individuals and find out what crypto projects they’ve worked on in the past.

Note that in some crypto niches, doxxing remains uncommon. For example, meme coin projects rarely dox their developers.

How to Participate in an IDO

The process to participate in an IDO is similar no matter which DEX is hosting the new launch. We’ll walk through the basic steps to participate in an IDO.

Step 1: Create a Crypto Wallet

Investors will need a crypto wallet in order to connect to a DEX and join an IDO. There are many free crypto wallets available, including MetaMask.

Investors should ensure that the wallet they choose is compatible with the token they want to purchase. That is, investors will need an ERC-20 token compatible wallet to purchase an ERC-20 token during an IDO.

Step 2: Add Tokens

To buy tokens during an IDO, investors will need a cryptocurrency supported by the DEX. Most DEXs support Ethereum, Tether, and a wide range of other cryptocurrencies, but investors should check whether there are limitations on what tokens are accepted for an IDO.

Investors can transfer tokens to their wallet from another crypto wallet. They can also buy crypto using fiat at a centralized crypto exchange and then transfer the tokens to their wallet.

Step 3: Connect to the DEX

Investors should navigate to the DEX that’s hosting the IDO ahead of the launch time and connect their crypto wallet. Simply click ‘Connect’ and follow the prompts to complete the connection.

Step 4: Invest

At the appointed time of the IDO, investors should enter the contract address for the IDO smart contract. This should bring up the IDO along with pricing information for the new token.

Investors can enter the number of tokens they want to purchase at the IDO price. They can then complete the purchase and the tokens will be transferred to their wallet.

References

- https://medium.com/clearpool-finance/uniswap-ido-details-b1e1ee77c426

- https://twitter.com/MilestoneBased/status/1507024441045401608/photo/1

- https://www.bloomberg.com/news/articles/2023-08-18/sec-moves-to-appeal-ripple-ruling-that-crypto-is-not-a-security

- https://cryptorank.io/fundraising-platforms/dao-maker

- https://www.reuters.com/business/finance/signs-crypto-winter-ending-regulatory-fog-begins-lift-2023-07-14/