An initial exchange offering (IEO) is when a new cryptocurrency lists on an exchange and becomes available to buy for the first time. Unlike ICOs (initial coin offerings), IEOs are conducted through centralized cryptocurrency exchanges.

In this guide, we’ll explain everything crypto investors need to know about IEOs, including how to find top IEOs as well as how to invest in them.

IEOs Explained

An IEO is a mechanism by which new cryptocurrency projects can offer a token to the public.

In an IEO, the token is distributed to investors through a centralized crypto exchange such as Coinbase, Binance, or Kraken. Investors must be a member of the listing exchange in order to participate in an IEO.

The exchange acts as a middleman for the token offering, managing trading and liquidity. Exchanges also typically conduct due diligence on new projects before participating in an IEO, although this isn’t required.

The project behind the new token raises funds in fiat or crypto by selling its token through an IEO for finance. The development team can use these funds for purposes including further project development, providing rewards to investors, and more.

IEOs are the crypto world’s equivalent to a stock launch or IPO (initial public offering). Some coins go straight to exchanges via IEOs, while others hold IEOs after initial ICOs (initial coin offerings), also referred to as crypto presales.

How Do IEOs Work?

To initiate an IEO, a new crypto project must contract with a centralized crypto exchange to list its token. Crypto exchanges are not required to list any new cryptocurrency, but they are often incentivized to host IEOs because these listings lead to additional trading volume, which generates revenue for the exchange.

Crypto exchanges usually conduct due diligence into projects before agreeing to host an IEO. Exchanges want to ensure that investors won’t be scammed or susceptible to a rug pull, which can tarnish the exchange’s reputation among crypto investors.

Once an exchange is satisfied with a project, the exchange and project will choose a date and time for the IEO. They’ll also determine how many tokens will be available and what price they will be sold at.

A portion of the proceeds from the IEO will typically go to the exchange in addition to a listing fee. The remainder of the proceeds will go towards funding the new project.

Importantly, in order for investors to participate in an IEO, they must be a member of the exchange. That means that IEOs are only open to individuals who reside in countries where the exchange operates and that investors must pass a Know Your Customer (KYC) check.

Some exchanges may put further qualifications on who can invest in an IEO. For example, the exchange might give priority access to institutional investors or investors who hold a certain volume of the exchange’s own token. They may also limit an IEO to investors who held an account at the exchange at the time of the IEO announcement, limiting the ability of new customers to join the IEO.

In the US, it’s important to note that the SEC considers IEOs to be securities offerings.

However, a recent court ruling found that tokens offered through exchanges are not securities. The SEC is appealing this ruling, leaving it unclear whether IEO tokens are securities.

ICOs vs IEOs

In an ICO (initial coin offering), coins are listed directly for purchase by investors without going through a crypto exchange. Many ICOs use crypto presales, airdrops, or other mechanisms to distribute tokens without a middleman.

IEOs are similar to ICOs in that both enable new crypto projects to sell tokens and raise funds. However, there are some important differences between ICOs and IEOs.

Exchange Membership

ICOs are fully open to the public. Anyone can join an ICO without having to sign up for an exchange. IEOs, on the other hand, require investors to be a member of the listing exchange.

This is important because in an IEO, the exchange can limit who has access to a new token. For example, an exchange could provide access to an IEO only to investors who hold a certain amount of the exchange’s own token. The exchange can also limit access to an IEO to investors in certain countries.

In addition, most IEO providers require investors to complete KYC requirements in order to join. This means that investors must provide and verify their identity in order to join an IEO. Identity verification is typically not required to join an ICO, which means that investors can purchase a new crypto token anonymously.

Due Diligence

Prior to hosting a financial IEO, most exchanges conduct due diligence on projects to ensure they’re safe and fair to investors. This can help weed out scammy token offerings, but it can also give investors a false sense of security. Not all IEO providers perform due diligence, and even for those that do there’s no guarantee that an IEO will perform well.

ICOs don’t come with any stamp of approval from an exchange. Investors have to be on the lookout for scams on their own. This can be a good thing since it means investors have to do their own research and fully understand a project before deciding whether to invest.

Fees

One of the most important differences between IEOs and ICOs for new crypto projects is the cost of each type of public sale.

For an IEO, crypto exchanges normally charge a listing fee that can be quite high. In addition, exchanges might take a commission on every token that’s sold during an IEO. So, new projects might earn a lot less cash that the total amount they raise through an IEO.

With an ICO, there are few to no fees for projects. Investors typically pay the blockchain transaction fees associated with purchasing a new token. Crypto projects keep the full amount they raise by selling their tokens.

IEOs vs IDOs

An IDO (initial decentralized exchange offering) is very similar to an IEO, but involves listing a token on a decentralized exchange (DEX) instead of a centralized exchange.

Due Diligence and Approval

The main difference between IEOs and IDOs lies in the listing approval process.

During an IEO, researchers at a centralized exchange talk with the project team, scrutinize the project’s tokenomics, and come to a decision about whether to list the token.

During an IDO, the DEX’s community is responsible for approving a new listing. This can be done by a vote, but in practice most DEXs simply list all new tokens without a formal approval process. So, tokens listed through an IDO often don’t undergo the same due diligence process as tokens listed through an IEO.

Exchange Membership

Another important difference is that IDOs are open to anyone, much like ICOs. Most DEXs don’t require investors to sign up or create an account. They simply have to connect a crypto wallet to join an IDO.

This also means that investors in an IDO don’t have to go through KYC requirements and can invest in tokens anonymously.

Why Do People Invest in Initial Exchange Offerings?

There are several reasons why investors like IEOs and look to them to find new tokens.

Price Speculation

The number one reason why investors purchase tokens through IEOs is the same reason they buy tokens through ICOs and IDOs: they want to speculate on the price of a new cryptocurrency.

IEOs offer a chance to get in on the ground floor of a new crypto token. Many investors who join an IEO believe that the price of the token will go up. They can then sell the token for a profit.

There’s no guarantee that an IEO—or any other crypto token listing—will result in a profit. However, many tokens pop in price after an IEO since demand is high and supply is limited.

Binance has held 17 IEOs since launching Binance Launchpad in 2017 and these tokens saw an average first-day price increase of 1,458%.

IEO tokens are always available for trading on the exchange they list on after the IEO is finished, so there’s a steady pool of liquidity for buying and selling.

IEO investors can also potentially earn a profit through staking rewards and lending their tokens. Staking and lending are often most valuable when a project is new and the token supply is limited.

Reduced Risk of Fraud

One of the benefits of IEOs compared to ICOs and IDOs is that centralized exchanges employ teams of researchers to vet crypto projects before listing their tokens.

The vetting process varies from one IEO provider to another, so investors still need to do their own research. But the approval process for an IEO can help weed out scams, rug pulls, and poorly developed projects that might not be suitable for public investors.

Simplified Access to New Tokens

Another advantage to investing in an IEO is that centralized exchanges make it relatively easy for beginner crypto investors to buy new tokens.

Many centralized exchanges let investors join an IEO with fiat as well as a wide range of cryptocurrencies. At many exchanges, investors can even use a credit or debit card to invest in an IEO.

On top of that, centralized exchanges don’t require investors to have their own self-hosted crypto wallet. The IEO provider keeps track of the tokens an investor buys during an IEO and ensures they’re safe. An investor can easily exchange them for any other token available at the exchange whenever they want.

Why Investing in an ICO Can Be Better Than an IEO

While IEOs have some benefits, many crypto projects choose to make their tokens available to investors through an ICO instead. ICOs have several important advantages over IEOs that make them the distribution mechanism of choice for new cryptos.

Get in Early at a Lower Price

It’s not uncommon for hyped cryptocurrencies to see big price increases very quickly after listing on an exchange. This means that unless you buy the coin quickly upon listing, you could end up paying a higher price than you would’ve previously.

By investing at the ICO stage, you can buy tokens at a set discounted price. If the token’s price then pumps following the IEO, you’ll be able to sell it and potentially make more profit than you would’ve if you bought the token when it was already live.

Open to Anyone

One of the biggest reasons that many crypto projects use ICOs is that they make a new token available to any investors. There’s no exchange acting as a middleman, so investors don’t need to be members of a specific exchange or own a specific token already. All investors need to do to join an ICO is have their own crypto wallet.

This democratization is part of the core ethos of the crypto industry, and it can help attract investors to a new project. Many crypto enthusiasts are turned off by IEOs simply because they aren’t fully decentralized.

No KYC Requirements

ICOs typically don’t follow KYC requirements or require investors to reveal their identities. Investors can purchase tokens during an ICO completely anonymously.

That’s a major benefit for crypto investors who prioritize privacy. It’s also good for investors in countries that have restrictions on cryptocurrency investing. These investors may not be able to join an IEO, but they are still able to take part in ICOs.

Lower Fees

ICOs don’t come with hefty listing fees like IEOs do. That’s a big deal because it means that projects get to keep nearly 100% of the proceeds from their token sale. Those proceeds can then be used to further develop the project, potentially increasing the token’s value in the future.

Alternatively, in the absence of listing fees, projects can offer their tokens at a lower price in an ICO than they would during an IEO. For ICO investors, that means there’s greater upside potential in the token if it reaches the same market cap.

Potential Risks of IEOs

Like all crypto investments, IEOs carry risks, and there’s no guarantee you’ll make returns on your money. After all, many meme coins have seen huge surges in value following their IEOs only to tank afterward, leaving some investors out of pocket.

Some traders do consider IEOs less risky than ICOs, particularly when they’re held on leading exchanges. This is because IEO projects are put through a rigorous vetting process before they’re accepted by exchanges.

Either way, you can safely invest in both ICOs and IEOs provided you carry out your due diligence and are aware that, like with any investment, there’s no guarantee of profit.

How to Find IEOs

One of the trickiest parts of investing in crypto IEOs is finding projects before they become oversubscribed. We’ll cover some of the best ways to discover IEOs before they take place.

Monitor Exchange Launchpads

IEOs by definition take place on centralized exchanges. So, investors can monitor announcements from major exchanges to learn about the latest IEOs and the requirements to invest in them.

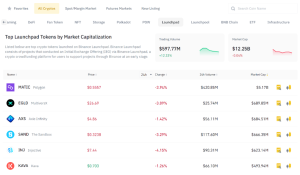

The major exchanges each have their own platforms for IEOs. At Binance, it’s Binance Launchpad. At Huobi, it’s Huobi Prime. Coinbase has Coinbase Ventures.

Investors can check these platforms to see what IEOs are coming up. It’s a good idea to keep a close eye on social media channels as well, since this is where exchanges make most of their announcements about new token listings.

Investors can also look at IEO hedge funds, which are funds that primarily invest in IEOs. These can be a useful source of information about which exchanges and sub-industries are hot right now.

Research IEOs Using ICOBench

ICOBench offers a number of tools to help investors find promising IEOs. First, our calendar tool shows all upcoming coin listings including ICOs and IEOs. Investors can find projects on the horizon with Tier 1 and other highly trusted exchanges.

We also conduct reviews and ratings of IEO projects. These can be valuable for finding hidden gems and projects that have flown under the radar. Investors can also use reviews and ratings to do their own research on IEO cryptos so that they’re not fully reliant on crypto exchanges’ due diligence.

New crypto projects almost always have a presence on social media, including Twitter, Discord, and Telegram. Joining the social media channels for a project is a great way to find out where and when it’s planning to list its token. Often, investors can communicate directly with a project team to better understand the IEO requirements and why a project chose to list with a specific exchange.

Of course, monitoring social media requires that investors already have a shortlist of crypto projects they’re watching. Investors can build that shortlist using ICOBench, then follow up on social media.

How to Pick High Potential IEOs & Avoid Scams

While exchanges perform some due diligence on IEOs, there’s no guarantee that they filter out all scammy projects. There’s also no guarantee that a token will rise in value just because it held an IEO on a major exchange.

So, it’s up to investors to do their own research to find the best IEOs. Here are a few things to consider when choosing which IEOs to invest in.

Whitepaper

A crypto project’s whitepaper is its guiding document for investors and one of the best IEO sources. The whitepaper should clearly explain what the project is all about, including what problem it’s solving and what the token will be used for.

The more detailed a whitepaper is, the better. Many scammy crypto projects have brief whitepapers that leave a lot of vague details. Well thought-out projects, on the other hand, will cover everything from the project’s tokenomics to the target audience.

A crypto whitepaper will also typically cover the project’s development roadmap. This includes details about when the IEO will be held, whether there will be additional token releases, and when new features will be released to the community. Project roadmaps may be optimistic in their timing, but they should still be realistic about how long things will take.

Verification

New crypto projects can undergo verification through crypto audit services like Certik and Coinsult. These services comb through a project’s code, including its smart contracts, to ensure there are no bugs or scams built in. For example, an audit will ensure that the maximum supply of a project’s token is what’s advertised in the whitepaper.

Audits are a small but very important step that projects can take to show they’re serious about investor safety. Top IEO projects make their audit results publicly available for prospective investors to review.

Development Team Doxxing

Some of the biggest scams in crypto history have been associated with anonymous development teams. Anonymity lends itself to rug pulls and other bad behavior among project founders.

Legitimate projects fight back against this by doxxing their developers—that is, revealing their identities. This allows investors to know who’s behind a project and what their experience is. Investors can then make a decision about whether to invest based on whether the team is made up of high-quality developers who have a strong vision for the future.

Tokenomics

A project’s tokenomics should be covered in its whitepaper, but it’s worth discussing this aspect in more detail. Tokenomics will determine how many tokens are available during an IEO, whether a cryptocurrency is inflationary or deflationary, and whether there will be liquidity for trading a token after its launch.

There’s no single “best” formula for crypto projects to follow when determining their tokenomics. Investors should carefully evaluate to ensure that the tokenomics make sense for the project itself and offer opportunities for price appreciation.

How to Participate in an IEO

We’ll walk through how to participate in an IEO in a few easy steps. The process is similar for most major crypto exchanges and may vary depending on the requirements to join a particular IEO.

Step 1: Create an Exchange Account

The first thing investors need to do is to create an account with the exchange that will list the token they want to invest in. Since it can be hard to predict which exchange each token will list with, it can be a good idea for investors to have accounts at multiple crypto exchanges.

Most crypto exchanges will require new investors to go through the KYC process. This includes uploading a copy of the investor’s ID, taking a photo with their webcam, and verifying their phone number and email address.

Step 2: Deposit Funds

Once an investor has an exchange account, they can deposit funds. Most exchanges accept deposits by credit card, debit card, bank transfer, or e-wallet. Investors can also transfer crypto from a wallet they already own.

Step 3: Find Available IEOs

Check out our list of the top upcoming IEOs on our homepage to see what listings are happening and when. Investors should also check whether there are requirements to join an IEO, such as owning the exchange’s token.

Step 4: Invest

Once investors have found an IEO, they can sign up on the waitlist to invest when the IEO occurs. At that time, investors will receive an invitation to buy tokens at the IEO price using the funds they have already deposited with the exchange.

However, as we’ve said further up, many traders prefer to invest in ICOs rather than IEOs. When a hyped coin lists on an exchange, its price can often shoot up in a matter of minutes.

This means that if you’re not quick, you may end up buying the coin for a higher price than you could have. If you invest at the ICO stage, you can lock in tokens at a low price and then look to sell them if the price rises following the IEO.

What are the Best IEOs to Watch Now?

There are several crypto presale projects that are holding much-anticipated IEOs in the near future. Dogeverse is a new meme coin that’s racing through its presale and is set to end in a matter of days, while is one of the most successful ICOs of the year so far. Other IEOs to watch include those of our best ICO Drops list.

References

- https://www.sec.gov/oiea/investor-alerts-and-bulletins/ia_initialexchangeofferings

- https://news.bloomberglaw.com/crypto/ripple-token-is-a-security-in-institutional-sales-judge-rules

- https://www.binance.com/en/support/announcement/introducing-the-band-protocol-band-token-sale-on-binance-launchpad-360033102832

- https://www.linkedin.com/pulse/detailed-analysis-binance-launchpad-ieo-still-good-investment-wong/