The crypto market has crashed today amid fears of a potential trade war in the Americas, as well as subsequent inflation and economic instability, spurred by US President Donald Trump’s latest executive order.

Bitcoin Pulls Back Below $100,000

Over the past 24 hours, the global cryptocurrency market capitalization fell nearly 8%, currently standing at $3.25 trillion.

Additionally, the total crypto trading volume in the last day is $402 billion. This is significantly higher than the $100 billion-$200 billion we’ve been seeing over the past few days.

Barely any coins in the top 100 coins per market cap category are green today. And when it comes to the top 10 coins, all are red.

What’s more, six out of the eight (not taking the two stablecoins into account) recorded double-digit drops. The highest among these is Cardano (ADA)’s 17.1%, now trading at $0.7174.

At the same time, Bitcoin (BTC) dropped below the $100,000 mark, currently changing hands at $95,181.

Bitcoin, 7-day price chart:

Over the past day, BTC’s price decreased by 3.3%. It’s down nearly 4% in a week and 3% in a month, while it appreciated 122% over the past year. Also, the current price is 13% lower than the all-time high of $108,786 reached on 20 January 2025.

Ethereum (ETH) saw the second-highest fall after ADA. Its 15% decrease pulled the price below the $3,000 mark, now standing at $2,598.

Trump Intensifies International Tensions and Trade War Fears

The crash didn’t come out of nowhere. Given the political situation in the USA, specifically the trade-related threats made by its new-old President Donald Trump, it was perhaps to be anticipated.

Over the weekend, Trump signed an executive order that imposes tariffs on imports from Canada, Mexico, and China. This is a no-small deal given the massive consequences the decision will bear. Furthermore, it has expectedly raised an international clash, with the mentioned nations promising counteractions.

But when it comes to the impact on the crypto industry specifically, the new measure resulted in crypto investors cutting risk. They likely anticipate obstructed international trade, leading to a decrease in economic growth, followed by shrunken disposable income, meaning less capital for digital asset investment.

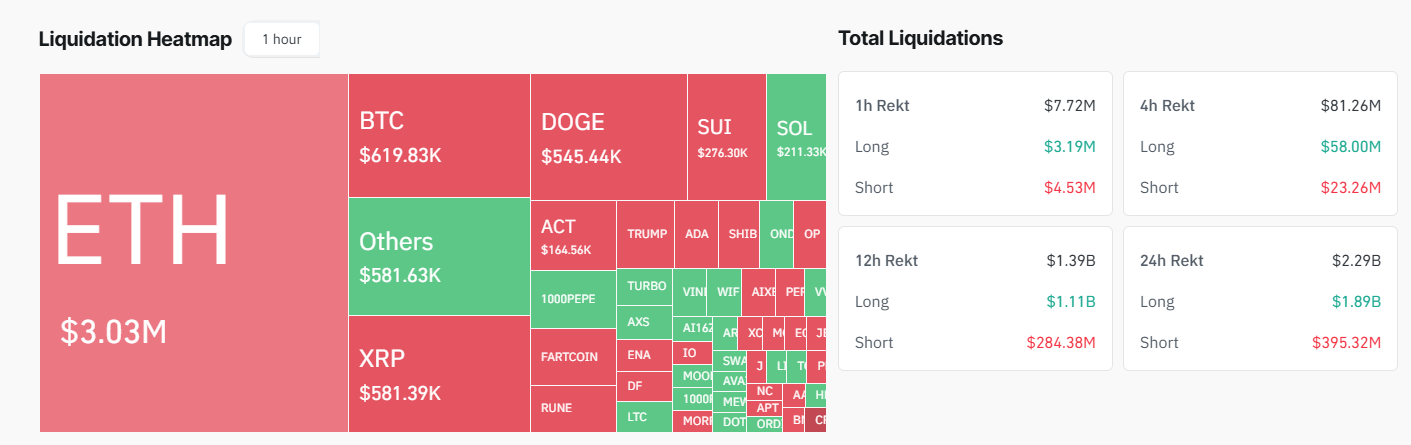

BTC’s fall below the psychologically relevant $100K mark led to a broader market sell-off. According to CoinGlass data, over the past 24 hours, 734,189 traders were liquidated, while the total liquidations amount to $2.29 billion. While this includes both long and short positions, $1.9 billion comes from long liquidations.

Petr Kozyakov, co-founder and CEO at the payment infrastructure platform Mercuryo, commented that “a tidal wave” of FUD (Fear Uncertainty and Doubt) has been “unleashed” on the crypto market after Trump’s Friday tariff announcement.

“The prospect of prolonged higher interest rates has rattled all global markets,” he said. “While Bitcoin has dropped below the $100,000 mark, the King of Crypto is once again proving itself to be in a class of its own in marked contrast to altcoins bleeding dark red across the board.”

US Spot Bitcoin ETFs See $5B Inflows in January

Meanwhile, the US spot Bitcoin exchange-traded funds (ETFs) saw nearly $5 billion in inflows in January, according to Bitwise CIO Matt Hougan.

Hougan said that spot Bitcoin ETFs pulled in $4.94 billion, an annualized rate of some $59 billion.

It's worth noting, there's significant month-to-month volatility in flows. Still, I think we end the year north of $50b.

Jan 2024: $1.5b

Feb 2024: $6.0b

Mar 2024: $4.6b

Apr 2024: (-$0.3b)

May 2024: $2.1b

Jun 2024: $0.7b

Jul 2024: $3.2b

Aug 2024: (-$0.1b)

Sep 2024: $1.3b

Oct.…— Matt Hougan (@Matt_Hougan) February 1, 2025

Furthermore, he said, compared to almost $5 million in January alone, these ETFs saw $35.2 billion in inflows during the entire 2024. This signals a growing investor interest in BTC-backed investment products.

While there is significant month-to-month volatility, Hougan said he still expects to see 2025 end with Bitcoin ETFs surpassing $50 billion in inflows.

Meanwhile, the resignation of the US Securities and Exchange Commission (SEC) Chair Gary Gensler on 20 January has resulted in renewed optimism and a rise in crypto ETF filings.

Read more: Major Exchange and Asset Managers Seek Solana, DOGE ETF Listings in the US