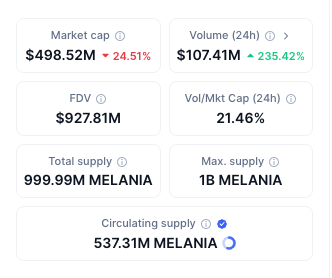

The First Lady’s meme coin, Official Melania Meme ($MELANIA), has lost a quarter of its value in the past 24 hours and currently stands at $0.9268 as the sell-off triggered by Bybit’s hack seems to be accelerating.

This is the first time that MELANIA is trading below the $1 mark since the token was launched. In the past 30 days, the asset has shed 64.3% of its value while it is now standing 93.2% below its all-time high of $13.73 per coin.

MELANIA’s circulating supply has more than doubled in the past few days, moving from around 200 million tokens on January 20 to 537.3 million at the time of writing.

This implies that 53.7% of the token’s total supply is already in circulation. Based on the token’s official website, 10% of the total supply should have already been unlocked for the launch team.

Moreover, a big portion of the community and treasury allocations, which account for 50% of the total supply, have probably been floated already to sell the asset before losses are even worse.

MELANIA Takes a Page Off the LIBRA Playbook

The collapse of MELANIA, whose market value dropped from $2.2 billion at some point after its launch to just $498.8 million at the time of writing, is remarkably similar to what happened with LIBRA – a token endorsed by Argentina’s head of state, Javier Milei.

However, Milei’s ties with LIBRA were relatively obscure, while in the case of MELANIA, the First Lady’s image is directly linked to the token.

Similarly, the price of Official Trump ($TRUMP), the meme coin sold and endorsed by the current President of the United States, Donald Trump, has experienced a 13.8% drop in the past 24 hours as well and has accumulated a 55.3% loss in the past month.

MELANIA’s daily chart shows no support levels in sight that could cushion the sharp downtrend that the asset has been experiencing since it was launched.

Its poor performance highlights the risk of investing in celebrity-endorsed meme coins. The tokenomics of MELANIA were unfavorable to investors from the get-go since only a small fraction of the total supply was sold to the public while insiders kept the majority of the tokens.

This increased the odds of a rug-pull. Different from LIBRA, the decline did not happen overnight, but losses are already exceeding 90% for those who bought at or near the token’s peak.

In contrast, projects with a clear value proposition like Solaxy ($SOLX) offer significant upside to early buyers.

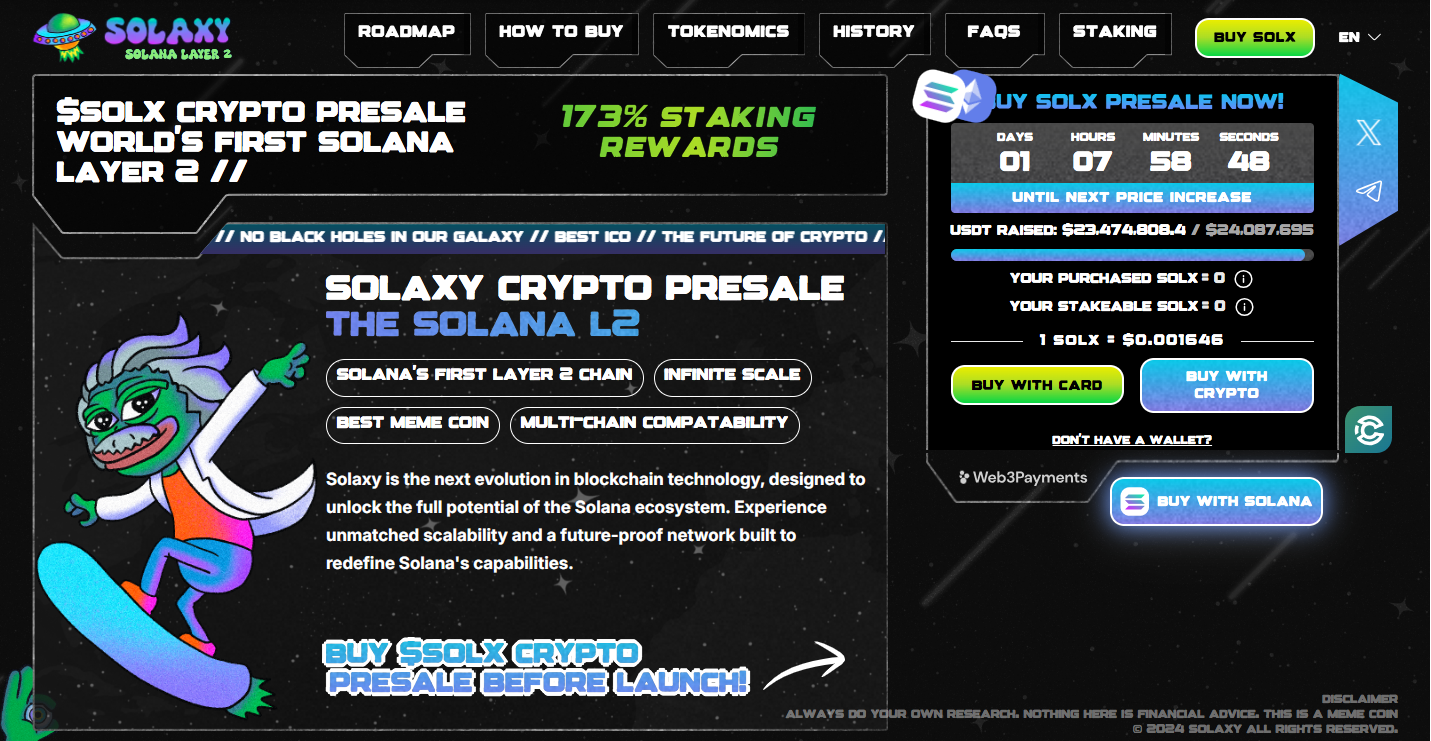

Solaxy ($SOLX) Raises Over $23M to Fix Solana’s Congestion Issues

Solaxy ($SOLX) is a layer-two scaling solution created to get rid of one of the main obstacles preventing developers from further adopting the Solana network to deploy decentralized applications (dApps).

Back in late January when $TRUMP was launched, the Solana network experienced severe congestion that resulted in delays and transaction errors. Even prominent crypto exchanges like Coinbase had to issue apologies to customers who were unable to fill their trade orders amid the network’s poor performance.

Solaxy fixes this by bundling transactions offline in its layer-two protocol before sending them to the mainnet. This alleviates the latter’s burden and increases its efficiency.

Developers have already provided encouraging updates about the project’s progress, including successful tests of asset transfers in the Solana devnet.

Apart from the upside potential that $SOLX offers to early buyers at its discounted presale price of $0.001646, staking rewards currently stand at 173% as well.

To buy $SOLX, visit the official website of Solaxy and connect your wallet. The presale event will end in just a few days so don’t miss out on this opportunity to grab one of 2025’s best ICOs before it hits the exchanges.