Looking to jump into the world of crypto but not sure how to start? Buying cryptocurrency with a credit card is one of the fastest and most convenient ways to get your hands on Bitcoin, Ethereum, and other popular coins. Whether you’re a first-time investor or just want to expand your portfolio quickly, this method offers speed, simplicity, and accessibility. But there are a few important things to know before you swipe. In this guide, we’ll walk you through the step-by-step process, highlight the pros and cons, and help you avoid common pitfalls when buying crypto with a credit card.

Let’s review some of the best apps to use in 2025 to buy crypto with a credit card.Best Place to Buy Crypto with Credit Card in 2025

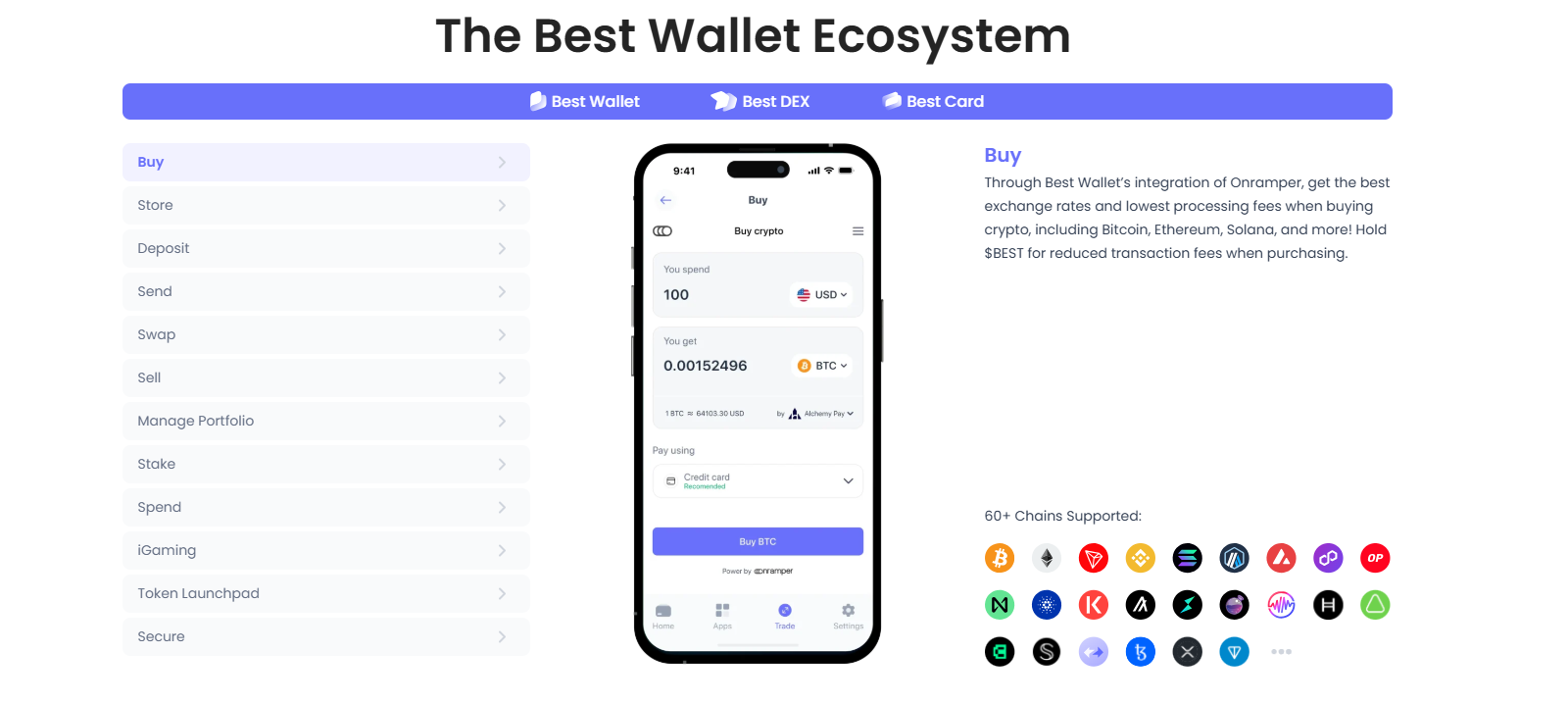

Download & Install Create or Import a Wallet Secure Your Recovery Phrase Buy, Store, & Swap Crypto

How to Buy Crypto with Credit Card

Grab the Best Wallet App from the App Store or Google Play. It’s free, fast, and highly rated for security and ease of use.

New to crypto? Tap “Create Wallet” to generate a secure, non-custodial wallet. Already have one? Select “Import Wallet” and enter your recovery phrase.

Write down your 12 or 24-word phrase and store it offline. This is your only way to recover your wallet—treat it like gold!

Buy crypto directly in-app, receive tokens, or connect to dApps. With its sleek interface and built-in swap features, managing your crypto has never been easier.

As previously mentioned, the Best Wallet serves as a superior option for purchasing cryptocurrency using a credit card. Its interface is designed for easy use, empowering a straightforward and intuitive process. Access the “Trade” section promptly and proceed to purchase your cryptocurrency using your credit card. One primary reason for recommending Best Wallet for purchasing crypto with a credit card is its support for various cryptocurrencies across multiple blockchain technologies and multi-wallet services. You can acquire a range of tokens, including Bitcoin and Ethereum, all through a single application, and execute trades utilizing your current wallets. Although non-custodial, Best Wallet places a strong emphasis on security measures. Hardware wallets may offer a marginally higher level of security, but Best Wallet employs biometric authentication and two-factor authentication to safeguard your funds and credit card information. Best Wallet also offers some of the best gas fees when buying crypto. Especially if you use the $BEST token and the best wallet ecosystem. 0% trading fees.

1. Best Wallet: Best Overall for Buying Crypto with Credit Cards

✅ Pros

❌ Cons

Easy to use interface

No live support in the mobile app.

Supports multiple cryptocurrencies, low gas fees.

The non-custodial nature places more security responsibility on you.

Strong security features (biometric authentication, 2FA)

Does not support NFTs.

Multi-chain support (Binance Smart Chain, Ethereum, Polygon)

MEXC serves as a practical application for acquiring cryptocurrencies using a credit card. The platform offers a comprehensive array of digital currencies and trading pairs, presenting you with profitable trading opportunities. MEXC implements competitive trading fees, frequently offering rates that are lower than those of other exchanges (usually 0 to 2%). MEXC supports multiple payment options, including credit cards. It enables the direct purchase of cryptocurrency using fiat currency, perfect for getting into crypto trading. The platform is recognized for its substantial liquidity and robust trading infrastructure. Suitable for both novice and experienced traders. However, MEXC is restricted in the US and Canada. So double-check its availability in your region before making any transaction.

2. MEXC: Gateway to Seamless Credit Card Transactions

✅ Pros

❌ Cons

Wide selection of cryptocurrencies (over 2,800)

Limited fiat options for some users.

Competitive trading fees (0% within EEA, 2% outside EEA)

Not regulated by major financial bodies.

Supports various payment methods (credit cards, bank transfers)

Some users reported customer support issues.

High liquidity and robust trading infrastructure

Restricted in several countries, including the U.S. and Canada.

Margex is a useful tool for purchasing cryptocurrency with a credit card, thanks to its user-friendly interface. This facilitates navigation and enables the acquisition of digital currencies such as Bitcoin and Ethereum with ease. The platform supports multiple payment methods, including credit cards. Additionally, Margex provides comprehensive market information and a robust order book with equitable prices unaffected by individual trader manipulation. The fees are competitive, 0.019% fee for limit orders and 0.06% for market orders. The application prioritizes safety by utilizing cold storage for most user funds and implementing advanced encryption methods to protect data. Your trades are secured, ensuring the protection of your assets. Additionally, Margex offers a complimentary converter for users to exchange various cryptocurrencies without incurring any additional fees. It is important to note that Margex operates without regulation and is based in Seychelles, which may raise concerns for certain users.

3. Margex: Trade with Ease

✅ Pros

❌ Cons

Easy purchase process

Limited fiat support for withdrawals

Robust security

Regulatory concerns

User-friendly Interface

Withdrawal time limitations

Competitive fees

Spot trading not available

BloFin provides an extensive array of user-friendly and secure functionalities. Cryptocurrencies can be acquired using more than 80 fiat currencies from various regions. BloFin offers an interface that is accessible to both novice and experienced traders. Spot Trading fees are 0.10% for both maker and taker. Futures trading are 0.02% and 0.06%. BloFin prioritizes security by implementing advanced measures such as Merkle Tree proof of reserves and collaborating with Fireblocks and Chainalysis. These features safeguard your assets against cyber threats and guarantee accountability for reserve management. BloFin also provides educational resources via its academy, ensuring you remain updated on the crypto market. It is important to recognize that BloFin predominantly emphasizes crypto-to-crypto transactions. So there may be a limit to fiat withdrawals and regional restrictions.

4. BloFin: Limited FIAT Support

✅ Pros

❌ Cons

Extensive fiat support for purchases

Limited fiat support for withdrawals

Advanced security measures

High leverage risks

User-friendly interface

Regional restrictions

Competitive trading Fees

Limited educational resources for beginners

Copy trading feature

Customer support delays

OKX provides an effective platform for purchasing cryptocurrency using a credit card, as it includes multiple payment options. The “Express Buy” feature allows for the purchase of cryptocurrencies using a credit card, accommodating more than 90 fiat currencies. Furthermore, OKX offers an intuitive interface that facilitates seamless navigation and efficient management of your transactions. The platform provides support for various trading options, including spot, margin, and futures trading. Exploring more complicated trading strategies could yield benefits when using OKX. OKX charges 0.08% for maker orders and 0.10% for taker orders on spot trades. OKX prioritizes security by implementing Proof of Reserves and utilizing cold storage to safeguard user funds. This guarantees the security of your transactions and assets. Additionally, OKX provides competitive fees that can be lowered through the possession of its native token, OKB. Please note that OKX is unavailable in certain regions because of regulatory constraints, which may restrict its accessibility. Its fee structure can also be quite complex.

5. OKX: Low Credit Card Fees

✅ Pros

❌ Cons

Wide range of payment options

Limited availability in some regions

User-friendly interface

Complex fee structure

Competitive fees

Security concerns in the past

Advanced trading features

Fiat withdrawal fees not straightforward

Due to its user-friendly interface, Binance serves as a reliable option for making cryptocurrency purchases using credit cards. Through credit card transactions, the application enables users to purchase widely recognized cryptocurrencies such as Bitcoin and Ethereum. You can find this option under “Buy Crypto” on both the website and the application. Binance operates with a diverse array of currencies. This tool is compatible with nearly all platforms. Additionally, the application’s design facilitates the efficient management of your transactions. Binance charges 0.1% per trade on regular trades. For credit card deposits, the fee can be 2% or more. Be aware that certain locations may impose regulations that restrict your ability to utilize Binance. You may also face higher transaction fees than other platforms.

6. Binance: Broad Support Spectrum

✅ Pros

❌ Cons

Popular trading platform

Regional restrictions

Advanced security measures

Limited customer support

User-friendly interface

Higher fees for some transactions

Wide range of supported currencies

Complex fee structure

Bybit provides a simple process for purchasing cryptocurrency using credit cards. The “One-Click Buy” feature enables the acquisition of cryptocurrencies such as Bitcoin or Ethereum with ease. Choose your fiat currency and cryptocurrency, input the order amount, and verify the transaction. Bybit enables transactions using both Visa and Mastercard, facilitating a swift and efficient process for purchasing cryptocurrency. Furthermore, Bybit mandates identity verification to guarantee secure transactions and safeguard your account and funds. On ByBit, EU-issued Mastercard cards may have a 1.10% fee, while non-EU issued Visa cards might have a 3.05% fee. Additionally, there are fees for ATM withdrawals with the Bybit Card, such as a 2% fee after the first 100 EUR/USD withdrawal per month. It is important to recognize that Bybit may impose particular card linking and usage requirements, including the necessity for billing addresses to match. Also, the KYC may be a bother to some.

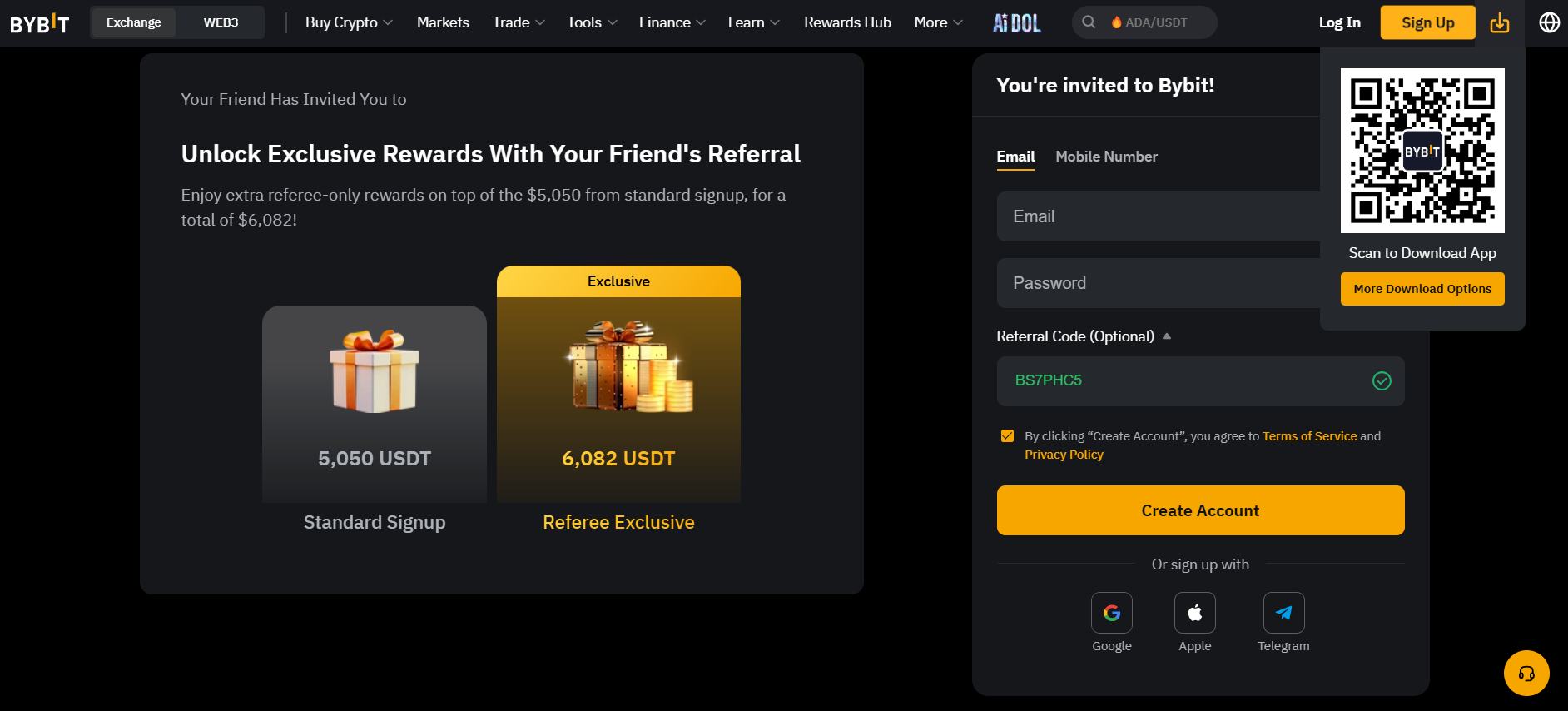

7. ByBit: Cool Interface

✅ Pros

❌ Cons

Easy purchase process

Identity verification required

Robust security measures

Limited availability in some regions

Multiple trading options

Card linking requirements

Supports major payment cards

Potential for higher fees

KCEX is not the best application for purchasing cryptocurrency using a credit card as it lacks support for direct fiat transactions. Purchasing cryptocurrencies directly with a credit card on KCEX is not permitted. To initiate trading, transferring cryptocurrencies from an alternative exchange or wallet is necessary. KCEX offers sophisticated trading tools and functionalities, featuring spot and futures trading with leverage options of up to 100x. The platform accommodates more than 200 cryptocurrencies and provides competitive trading fees, including 0% fees for spot trading. Furthermore, KCEX prioritizes security by utilizing cold wallets for asset storage and providing customer support around the clock. If you are looking to purchase cryptocurrency directly using fiat currency, consider exploring alternative platforms.

8. KCEX: No Direct Credit Card Support

✅ Pros

❌ Cons

0% spot trading fees

No direct fiat purchases

Robust security measures

Limited fiat support

User-friendly interface

High leverage risks

Advanced trading tools

No KYC may raise concerns

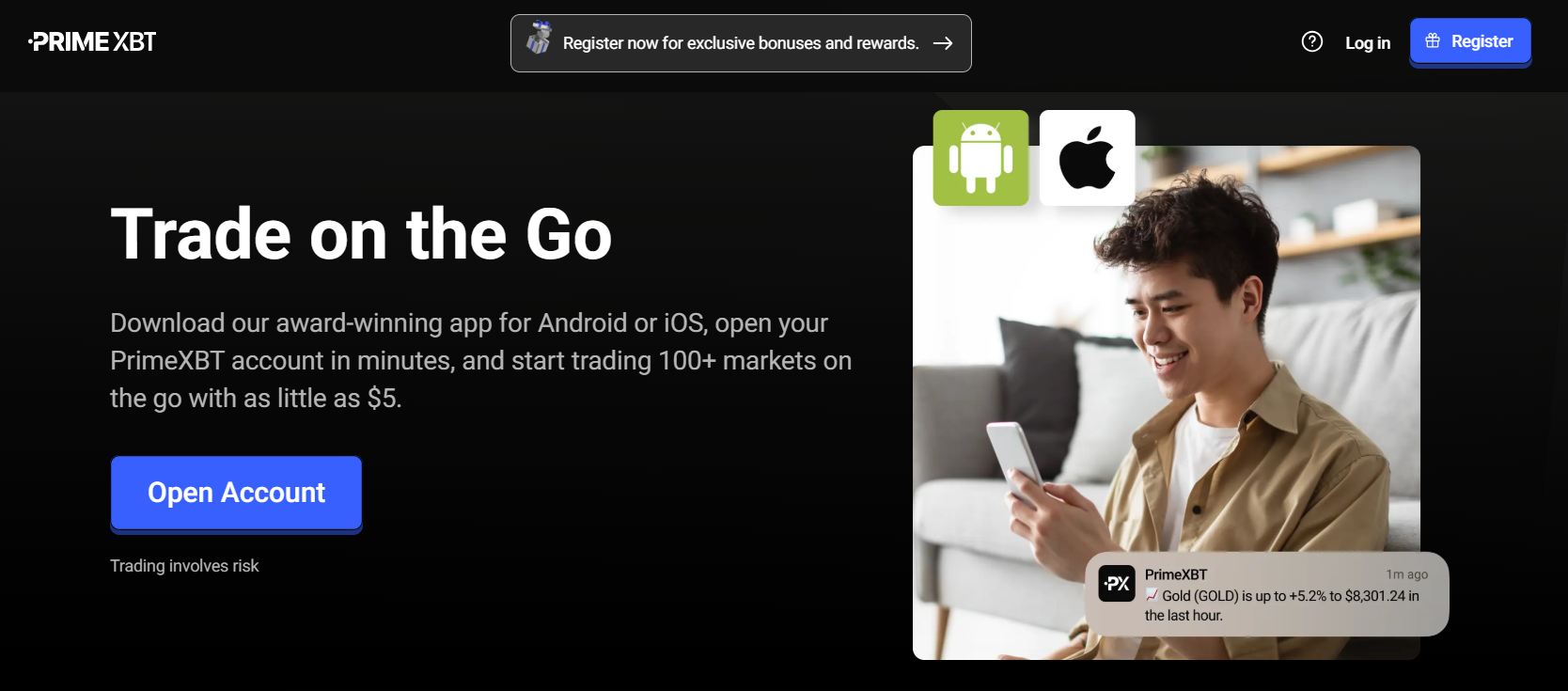

PrimeXBT allows deposits via credit card. For debit deposits, it collaborates with external services that enable the purchase of cryptocurrencies using bank cards, which are subsequently transferred to the PrimeXBT wallet. Furthermore, PrimeXBT facilitates fiat deposits through alternative methods, including AdvCash and Perfect Money. The platform set maker fee at 0.01% and a taker fee at 0.02% for Crypto Futures, and a 0.05% trading fee for Crypto CFDs. PrimeXBT incorporates external services to streamline fiat transactions and enable seamless funding of your account. The platform is primarily designed for futures trading, indicating that users will not possess the actual stock but will engage in speculation regarding its future price movements. PrimeXBT accommodates various fiat currencies, such as USD, EUR, and GBP. Due to legislative constraints, the accessibility of the service in question may differ based on your location.

9. PrimeXBT: Purchase with Bank Cards

✅ Pros

❌ Cons

Supports credit deposits

Does not support debit card directly

User-friendly interface

Limited cryptocurrency options

Competitive fees for futures trading

Higher withdrawal fees for fiat

Robust security measures

Not available in all regions

When evaluating BingX for purchasing cryptocurrency via credit card, it provides a good interface for users. BingX operates as a centralized exchange that supports multiple payment methods, such as Mastercard and Visa. Funding your BingX account with fiat currency is a straightforward process. It is important to note that credit card support is not explicitly stated for all regions; therefore, it is advisable to verify the availability of this option in your area. For EEA countries, the transaction fee is 1.50%, while for non-EEA countries, it’s 3.30%. BingX offers various trading options, such as spot trading, derivatives, and copy trading. This renders it appropriate for novices as well as seasoned traders. The platform includes two-factor authentication and Proof of Reserves certification. BingX operates in over 150 countries; however, it is inaccessible in certain regions, including the USA and the UK.

✅ Pros

❌ Cons

Generally supports fiat deposits via credit cards

Higher withdrawal fees for some currencies

Offers spot trading for immediate delivery

Requires KYC for fiat transactions

Provides copy trading features for beginners

Limited availability in certain regions

Offers robust security measures for user protection

Fiat deposits may take longer to process

KuCoin is a widely used exchange that provides a diverse range of currency pairs and payment options. The application and website facilitate the seamless use of credit cards for depositing fiat currency and purchasing cryptocurrency. Cryptocurrencies such as Bitcoin and USDT can be acquired using your Visa or Master credit card via the Fast Trade option. KuCoin doesn’t directly charge for credit cards. Spot fees start at 0.1%, while futures begin at 0.02% for makers and 0.06% for takers. KuCoin’s fast trade feature is designed to accommodate both novice and experienced users. Complete verification and confirm that your card is compatible with 3D Secure (3DS) to secure your account. The platform offers a range of payment options, such as bank transfers and several third-party services, accessible through the “Buy Crypto” link. The platform accommodates multiple fiat currencies, including USD, EUR, and GBP, enabling users to purchase cryptocurrency directly using their local currency. Furthermore, KuCoin prioritizes security by implementing multi-factor verification as well as encryption measures to safeguard your account. Their withdrawal fees, however, can be quite high. Check their fee rates first.

11. KuCoin: Large Multi-currency Support

✅ Pros

❌ Cons

Generally supports credit card transactions

Requires advanced verification

Offers multiple fiat currency options

High withdrawal fees

Provides a user-friendly Fast Trade interface

Limited availability of certain features globally

Offers good security measures

May incur additional fees from card issuers

Top Platforms to Buy Crypto with Credit Card – Comparison

The applications outlined earlier present distinctive benefits and drawbacks. Certain platforms exclusively accept USD-enabled credit cards, whereas others impose deposit fees. Let us compare to determine which option is the most straightforward and yields the highest profit.

App

Compatibility with Credit Card

Fees

Supported Cryptos

Supported FIAT

User Experience

Security (Credit Card)

Notes

Best Wallet

Varies by wallet provider

0% trading fees. Very low fees on gas, liquidity pool, and processing.

Depends on wallet functionality

Varies by wallet

User-friendly

Varies; generally strong security practices

Great for managing multiple assets

MEXC

Supports credit card purchases

0% within EEA, 2% outside EEA

Wide range of cryptos

USD, EUR, and others

Intuitive interface

Supports 2FA & encryption for transactions

Global access; strong trading features

Margex

Credit card purchases available

0.019% on limit orders, 0.06% on market orders.

Major cryptos plus derivatives

USD

Simple to use

2FA and transaction limits

Margin trading available

BloFin

Limited credit card support

Spot trading 0.10%, other 0.02% – 0.06%

Select major cryptocurrencies

Primarily USD

Moderate user experience

Limited security features for credit cards

Focused on security

OKX

Supports credit card payments

0.08% for maker orders, 0.10% for taker orders

Extensive crypto options

USD, EUR, and others

Easy to navigate

2FA, anti-fraud measures

Offers futures and spot trading

Binance

Broad credit card support

Over 2% card fee

Large list of cryptocurrencies

USD, EUR, GBP, AUD, and more

User-friendly

Strong security protocols for card use

High liquidity; extensive features

ByBit

Credit card purchases supported

Trading and other fees range within 0.02% to 2%. Card fees 1.1% to 3.1%

Major cryptos; derivatives available

USD

Smooth interface

2FA and withdrawal protection

Known for leverage trading

KCEX

Limited, check availability

0.01% takers fee on futures trading

Select cryptocurrencies

USD

Basic interface

Basic card security features

Less known, new entrant

PrimeXBT

Not directly via credit card

maker fee 0.01%, taker fee 0.02%. 0.05% trading fees

Popular cryptos focused on CFDs

Primarily USD

User-friendly

Not applicable for credit card purchases

Known for margin trading features

BingX

Supports credit card transactions

1.50% for EEA, 3.30% for non-EEA countries.

Diverse range of cryptocurrencies

USD, EUR, and others

Simple/engaging

2FA, secure payment gateways

Social trading features available

Kucoin

Supports credit card purchases

Spot fees 0.1%, futures at 0.02%

Wide variety of cryptos

USD, EUR, and others

Comprehensive UI

Offers 2FA and internal security measures

Offers staking and lending options

Buying Crypto with Credit Card – Pros and Cons

Using your credit card to purchase crypto can have both ups and downs. Quickly look at the pros and cons:

Pros

Cons

Quick and Convenient: Transactions are processed almost instantly. Quick investment opportunities.

High Fees: Includes credit card processing fees (2-3%) and cash advance fees (3-5%), significantly increasing the cost.

Increased Buying Power: Allows spending more than available cash, useful for large purchases.

High Interest Rates: Cash advance APRs can be very high (often around 30%), and interest starts accruing immediately.

Rewards: You can earn rewards like cashback or points; might be redeemable for crypto.

Market Volatility: Crypto prices can fluctuate rapidly, which may lead to losses greater than gains.

Digital Payment Method: Credit cards offer an alternative to cash for crypto purchases.

Debt Risk: Easy to overspend and accumulate debt if not paid off promptly.

No Cash Required: Allows investment without needing cash on hand.

Credit Score Impact: Missed payments can negatively affect credit scores.

Things to Consider Before Buying Crypto with Credit Card

The cryptocurrency market exhibits greater sensitivity and complexity compared to the stock market. The temptation is matched by significant financial risks despite relying on a credit card. Although credit cards are not directly associated with bank accounts, the potential financial risk remains substantial if your credit card data is breached.

Consider the following major topics before buying crypto with your credit card.

Security

When purchasing cryptocurrency using a credit card, ensuring security should be your primary concern. It is essential to prioritize your banking information and guarantee that your transactions remain secure from unauthorized access. We highly recommend choosing platforms with 2FA, Biometric security, and other advanced security measures.

Certain platforms provide anonymous crypto credit cards, which maintain user anonymity by associating transactions with a cryptocurrency wallet instead of a personal bank account. Choosing the right crypto wallet can mitigate the likelihood of fraudulent activity and prevent illegal access to your financial resources.

Ensure that the platform you select possesses adequate security measures to safeguard your data and possessions. Reviewing existing user feedback is a handy practice.

Transaction Fees

Transaction fees represent the expenses associated with purchasing cryptocurrency using a credit card. The fees associated with transactions may differ considerably based on the currency exchange or platform selected. A fee is generally incurred for a credit card transaction, which can include a proportion of the total purchase amount.

Generally, this fee doesn’t exceed 0.1% to 3%. Some platforms don’t charge for credit card deposits at all. However, gas fees, processing fees, and DEX fees may apply, even with no transaction fees.

Furthermore, it is important to note that there could be charges associated with the conversion of fiat currency to cryptocurrency; in certain instances, these charges may exceed those typically associated with traditional credit card transactions.

Certain platforms provide competitive fees, whereas others might impose higher charges for convenience or supplementary services. You should always examine the fee structure prior to initiating your transaction.

Transaction Times

Transaction times indicate the duration required for your cryptocurrency purchase to finalize and become accessible in your account. Utilizing a credit card for transactions typically results in immediate processing, allowing for instant access to your acquired cryptocurrency.

The speed is contingent upon the processing time of the exchange and the verification procedures of your bank. If previously verified, the transaction may be instant. However, it can also take up to 5 days in some cases (bank checks, availability, etc). Debit card purchases are mostly instantaneous.

Conformity checks or congestion in the network may result in delays for purchases; however, credit card transactions typically occur more swiftly than bank transfers. Verify the standard transaction durations for your platform and confirm that they align with your requirements.

Accepted Credit Cards

Compatibility must be a priority since we are purchasing cryptocurrency using a credit card, correct? Verify that the currency exchange or platform recognizes your card. Most platforms are compatible with leading credit card brands such as Visa and Mastercard. Some restrictions may apply depending on where you are or what kind of card in use.

It’s always a safer bet if you choose an exchange with plenty of listings. Find the best exchanges with the most coins for better compatibility with your credit card.

Some exchanges might decline credit cards from specific banks or regions because of regulatory restrictions. Prior to purchasing cryptocurrency, ensure that the card you’re using is compatible with the payment system of the platform.

Key Consideration: Extended Table

Here’s a table summarizing key considerations before buying cryptocurrency with a credit card:

Consideration

Description

Security

Ensure the platform uses sufficient security measures like two-factor authentication and encryption. Review user feedback for reliability.

Transaction Fees

Understand all fees associated with the transaction. Credit card processing fees and potential cash advance fees can be higher on some platforms. Look for free transactions.

Transaction Times

Verify that transactions are processed quickly, typically faster than bank transfers. However, it may vary based on exchange and verification processes. Ensure your card is active and suitable.

Accepted Credit Cards

Confirm that the platform accepts your credit card type (e.g., Visa, Mastercard) and check for any regional or bank-specific restrictions.

Financial Risks

Be aware of high interest rates and potential debt if not paid within a timeframe. Consider market volatility and the high chance of losses as well.

Chargebacks and Fraud

Understand that credit card companies may face risks like friendly fraud. Scams and frauds can impact their willingness to allow crypto purchases.

Why Use Best Wallet to Buy Crypto with Credit Card?

Best Wallet is a mobile-centric cryptocurrency wallet designed with a focus on user-friendliness and powerful security measures. The app is popular for the effective buying and management of assets. This wallet operates in a decentralized manner and is non-custodial, ensuring that you maintain complete control over your personal data.

When utilizing Best Wallet, it is important to note that you bear full responsibility for the integrity of your keys, in contrast to custodial exchanges or applications. This wallet ranks highly among cryptocurrency wallets with built-in exchanges.

The app is designed for intuitive use, ensuring a seamless experience for users. The options are distinctly labeled and accompanied by helpful prompts. Scrolling and swiping can be performed rapidly. The content is explicit, and the navigation controls are positioned at the bottom. The components consist of Home, Apps, Trade, and Settings.

The standard colors are bright and aesthetically pleasing; however, customization options are available to enhance personalization. Registration does not require an ID, and there are no Know Your Customer (KYC) requirements in place.

Best Wallet is compatible with more than 60 cryptocurrencies. The platforms encompassed are Binance Smart Chain, Ethereum, and Polygon. Tokens can be traded across various chains throughout the wallet. It enables access to applications running on Web3. It accommodates various wallets.

Best Wallet Key Features

Let’s take a quick look at the key features of Best Wallet.

- Compatible with more than 60 cryptocurrencies on Binance Smart Chain, Ethereum, and Polygon networks.

- Enables the trading of tokens across various chains directly from the wallet interface.

- Supports smooth integration with a range of Web3 applications.

- Lets you oversee various wallets within the application.

- Includes an integrated exchange for token swaps.

- This wallet operates on a non-custodial basis and offers support for multiple blockchain networks.

- Facilitates the generation or integration of numerous wallets.

- Monitors current gains or deficits.

- Includes market insights, such as trending tokens and prevailing market sentiments.

- Enables the acquisition of $BEST tokens via airdrops.

- You can receive airdrops for $BEST tokens by using the Best DEX.

Best Wallet: Upcoming Features

Best Wallet constantly evolves based on your needs. Each update features more useful tools, settings, and apps. Here are some of the highly anticipated en-route features:

- The Staking Aggregator: Best Wallet provides a streamlined interface for discovering and accessing multiple staking opportunities across different blockchains. This will greatly streamline the process of earning incentives on your cryptocurrency assets.

- NFT Gallery: At present, the Best wallet lacks support for NFTs. Future updates will include a designated area within the wallet for viewing, managing, and showcasing non-fungible tokens (NFTs). NFT collectors, please remain attentive!

- Browser Extension: The wallet is mainly designed for mobile use, leading PC users to express a consistent demand for a version of the app compatible with Windows, MAC, and Linux systems. A plugin for the browser is currently in the development phase. This will further improve the capabilities of Best Wallet by enabling access to decentralized programs (dApps) and cryptocurrency-related websites directly through your PC browser.

- Market Intel Analytics: Market analytics serve as the essential foundation for any trading activity, whether in stocks or cryptocurrencies. A newly developed analysis tool will provide real-time market information, analytics, and insights directly within the wallet interface. The tool is designed to support your trading decisions by analyzing trends, sentiment, and various market metrics.

- Derivatives Trading: Best enables users to engage in crypto derivatives trading (e.g., futures, options) straight from the wallet. Anticipate the emergence of more sophisticated trading strategies and opportunities.

- Gas Token-Free Transactions: Best aims to remove or lessen your need to possess and utilize native gas currency (e.g., ETH on Ethereum) for fees associated with transactions. The wallet includes a native ecosystem that utilizes $BEST tokens. Utilizing $BEST minimizes gas fees and enhances the potential for more lucrative transactions. It has recently broken $10 million in presales.

- News Feed: In-Application Best Wallet is set to incorporate a news feed straight within the wallet interface. A dedicated feed will provide the latest updates, news, and developments in the cryptocurrency sector from multiple sources. Any changes in market trends will be displayed directly on your wall.

Best Wallet: Security Features

Using credit cards with Best Wallet is a secure option for several reasons.

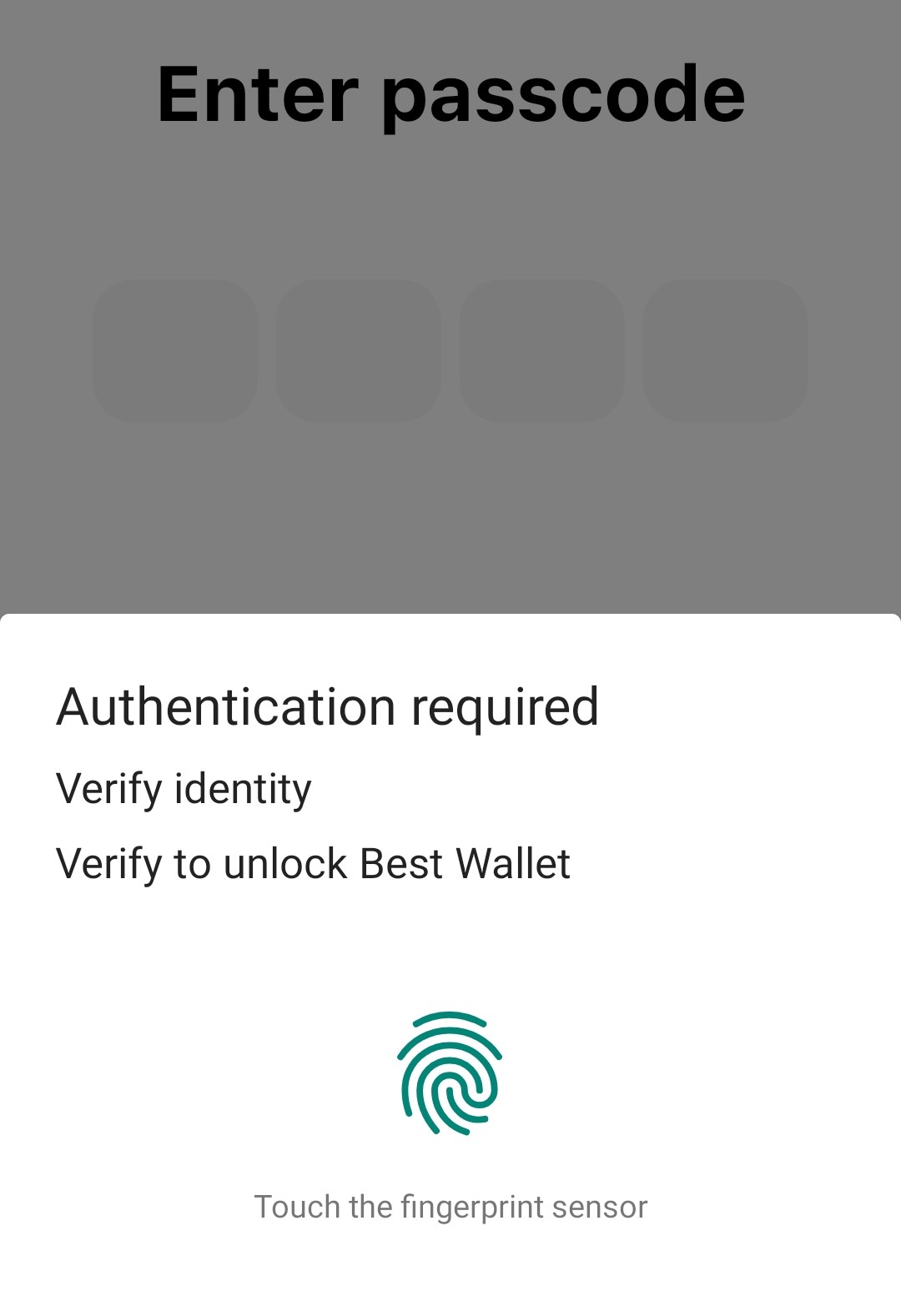

- 4-Digit Passcode: This serves as a fundamental security protocol. The wallet is safeguarded against unauthorized access. The code must be entered by users to access the application.

- Biometric Security: Best operates on your Android or iOS smartphone, leveraging its biometric security features for enhanced protection, including Face ID and fingerprint scanning. The method provides enhanced security and convenience for accessing the wallet. Configuring the biometric lock guarantees that only you can access your assets, even if the device is lost or stolen.

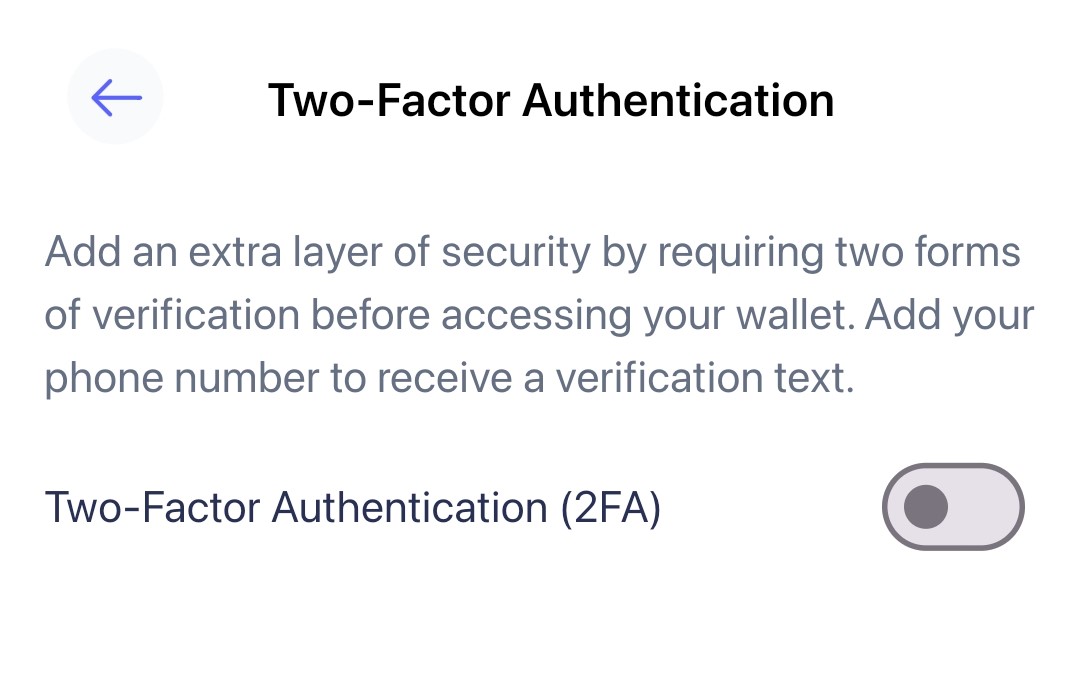

- Two-Factor Authentication: This process utilizes your cell phone number for verification. This feature enhances security during the login process. A code will be sent to the mobile device during the setup process to verify your identity.

- Concealing Suspicious Tokens: Best Wallet conceals suspicious tokens to safeguard you against scams. When the system identifies a potentially risky asset, interaction with it will be restricted.

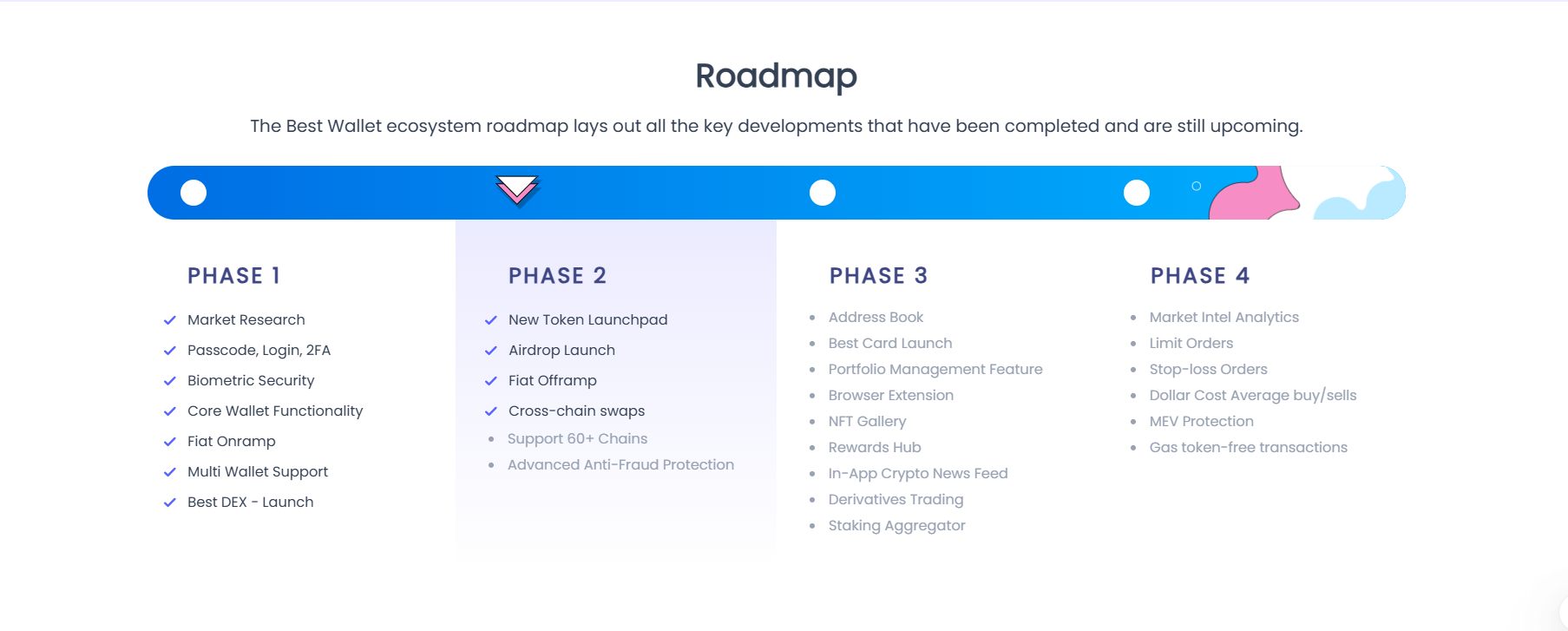

Best Wallet Roadmap

Best Wallet outlines a comprehensive plan for future development.

Phase 1 encompassed market research, mobile login implementation, and integrating biometric security measures. The essential functions of the core wallet are accessible. Fiat off-ramps are currently unavailable. It is possible to purchase cryptocurrency using fiat currencies. The most effective decentralized exchange facilitates token exchanges. The Airdrop distributes tokens to users as rewards.

Phase 2 encompasses a token launchpad that provides early access to new tokens. Cross-chain swaps operate across more than 60 networks, with advanced anti-fraud protection ensuring the security of transactions. The Best Card lets users utilize cryptocurrency on platforms like Google Pay and Apple Pay.

Portfolio tracking and integration of NFTs are also provided. Subsequent phases will focus on enhanced functionality, delivering sophisticated trading features and comprehensive market analytics.

Can You Buy Cryptocurrencies Anonymously with a Credit Card?

You can buy anonymously with a credit card through a KYC-free platform like the Best Wallet. Since it’s a non-custodial app, it does not hold credibility for your keys; thus, it does not require your personal data. Check out some of the best no-KYC crypto exchanges while you’re at it.

How To Buy Crypto with Credit Card – Conclusion

People commonly buy crypto with credit cards during their first asset acquisitions. Later, trading crypto for crypto becomes more profitable and safer. Whether you’re a new investor or topping up a new account with a credit card, we recommend using Best Wallet for maximum safety, profitability, and anonymity.